Labour Win Election – What’s Next for Your Finances?

Friday 5 July, 2024

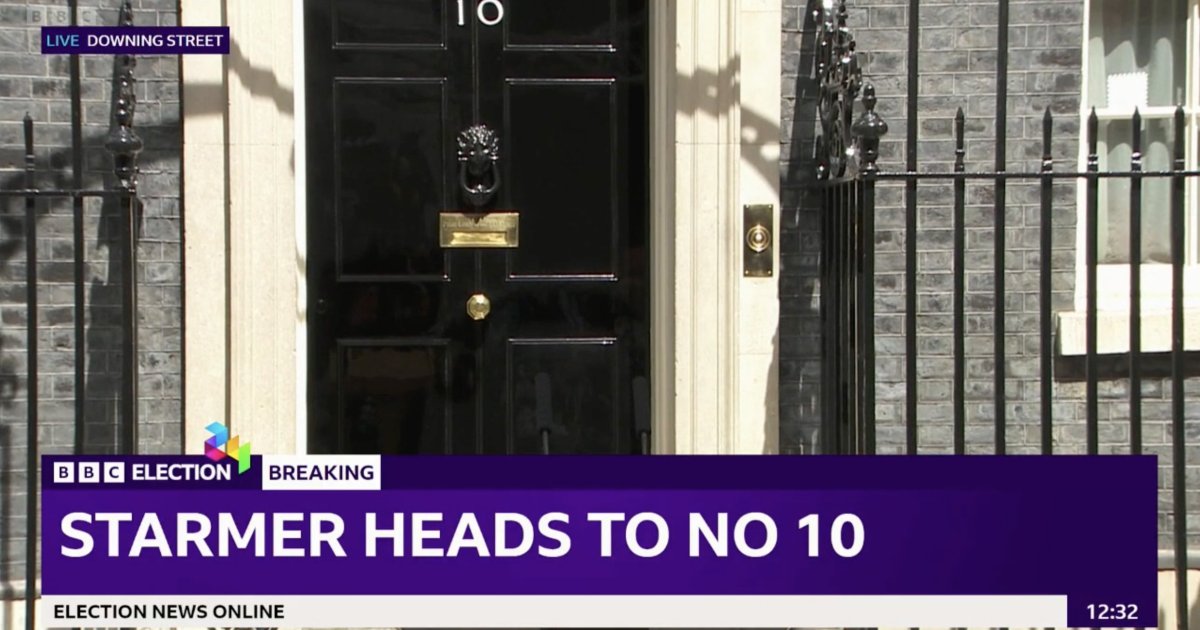

Labour has secured a decisive victory in the recent election, a result widely predicted by analysts. As the party prepares to implement its agenda, significant changes could be on the horizon for personal finances and the broader economy. Richard Porter, Independent Financial Adviser in St Albans, takes a look at what we might expect under the new government.

Immediate announcements and economic strategies

While Labour might make some early announcements to signal a new direction, major economic decisions will likely be reserved for later in the year. Incoming Chancellor Rachel Reeves has confirmed there will be no Budget before September, and even then, no surprise tax changes are planned.

Labour has committed not to raise the rates of income tax, national insurance, VAT, or corporation tax. However, this has sparked concerns that other taxes, such as capital gains tax, inheritance tax, council tax, or pension tax relief, might be targeted to raise revenue.

As ever, our team of financial advisers and researchers are keeping a close eye on tax news. We need to be aware, as early as possible, of any tax increases that may directly impact our customers’ investments, savings and tax mitigation vehicles.

Key Financial Policies

Economic Growth and Investment: New Prime Minister Sir Keir Starmer has pledged to prioritise economic growth. Central to this strategy are the launch of a publicly-owned company, Great British Energy, a National Wealth Fund, and new housebuilding targets.

- Great British Energy: This initiative aims to invest billions in clean, home-grown energy, creating jobs and enhancing energy security. It will be partially funded by closing loopholes in the windfall tax on oil and gas companies.

- National Wealth Fund: This fund aims to finance ports, new gigafactories, and help rebuild the steel industry, promoting long-term economic stability.

Labour’s economic approach, dubbed "securonomics," focuses on sustainable and secure economic management.

Tax Policies: Labour intends to cap corporation tax at 25% and replace the business rates system with a fairer revenue-raising method. Despite the pledge not to raise individual tax rates, fiscal drag will increase tax revenue as income tax thresholds remain frozen until 2028, effectively pushing more people into higher tax brackets.

The cap to corporation tax is welcomed; however, it remains to be seen if the replacement of the current business rates system will become Labour’s ‘Business’ Poll Tax.

Labour’s Pledges and Potential Impacts

Minimum Wage: Labour promises to ensure the minimum wage is a "genuine" living wage by adjusting the Low Pay Commission's remit to account for the cost of living. The party also plans to eliminate age bands, allowing all adults to receive the same minimum wage, which will result in pay increases for many workers.

State Pension: Labour has committed to maintaining the state pension triple lock, guaranteeing annual increases based on inflation, average earnings growth, or 2.5%. However, the party has not committed to protecting the state pension from income tax, unlike the Tories’ Triple Lock Plus plan. Labour will review the pensions landscape to improve outcomes and increase investment in UK markets.

Housing and Homeownership

Building More Homes: Labour’s ambitious plan to build 1.5 million homes over the next five years includes reforming the planning system and changing compulsory purchase compensation rules to lower costs and accelerate development. The focus will be on brownfield sites and lower quality ‘greybelt’ land, with fast-track approval processes.

Support for First-Time Buyers: Labour plans to introduce the Freedom to Buy scheme to help first-time buyers secure mortgages. This will be funded partially by housebuilders. Additionally, a permanent mortgage guarantee scheme will assist those struggling to save for a deposit, with local people given priority on new developments.

Transport and Infrastructure

Fuel Duty and Electric Vehicles: Labour may increase fuel duty, currently frozen until March 2025, potentially raising costs for motorists. The party plans to bring forward the ban on new petrol and diesel cars to 2030 and expand the charging network to facilitate the switch to electric vehicles.

Road Maintenance: Labour has pledged to fill an additional one million potholes each year, aiming to reduce repair bills and insurance premiums by improving road conditions.

Education and Taxation

Private School Fees: Labour plans to remove VAT and business rates exemptions for private schools, potentially increasing fees by up to 20%.

Capital Gains and Inheritance Tax: Although Labour has no immediate plans to increase capital gains tax rates, the lack of a definitive stance may cause concern among investors and Lonsdale customers. Inheritance tax is also under scrutiny, with potential reforms on the horizon following recommendations from the now-abolished Office of Tax Simplification.

We recommend speaking to your financial adviser as soon as possible if you are concerned about Inheritance Tax or any other taxation changes that may affect your wealth.

Conclusion

Labour’s landslide victory marks a significant shift in the UK’s political landscape, with potential far-reaching impacts on the economy and personal finances. While some details remain to be clarified, the party’s commitments to sustainable growth, fairer taxation, and improved living standards signal a transformative agenda for the country. As the new government settles in, the specifics of these plans will become clearer, shaping the financial future for individuals and businesses alike.

The value of your investments can go down as well as up, so you could get back less than you invested. The Financial Conduct Authority does not regulate estate planning or tax planning. The information contained within this article is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases and reliefs from taxation may be subject to change. The information contained within this article is for guidance only and does not constitute advice which should be sought before taking any action or inaction.

Latest News Next Article Previous Article