US economy – are cracks beginning to appear?

Tuesday 2 July, 2024

Wealthy Americans are spending at healthy rates, driving strong overall demand. However, there are early signs that low- and middle-income consumers are starting to cut back. Call it a two-speed economy. Does it matter? Of course.

In recent years, spending patterns have shifted. During the pandemic, benefits, accumulated savings, and robust wage increases bolstered spending across all income brackets. Given lower income groups typically have a higher propensity to consume, a broad-based increase in consumer spending is preferable, as money is recycled through the economy at greater rates, with benefits felt far and wide.

Diverging economic indicators

The big picture remains strong. The jobs market is robust, inflation is cooling (albeit slowly), and real wages are increasing. However, the US economy is not quite as bulletproof as it appears when you look under the hood.

Economists and CEOs of US companies, particularly those who are consumer-facing, are warning that the much-predicted spending slowdown has arrived, but it’s highly concentrated amongst one sector of the population. As noted, this risks causing further knock-on negative benefits, as reduced consumption from lower income groups works its way through the economy.

Whilst not a perfect comparison, we are seeing this effect through the varying performance of different market capitalisation stocks in the US. Smaller stocks, those more geared to the local economy, have lagged their larger peers since the start of the year.

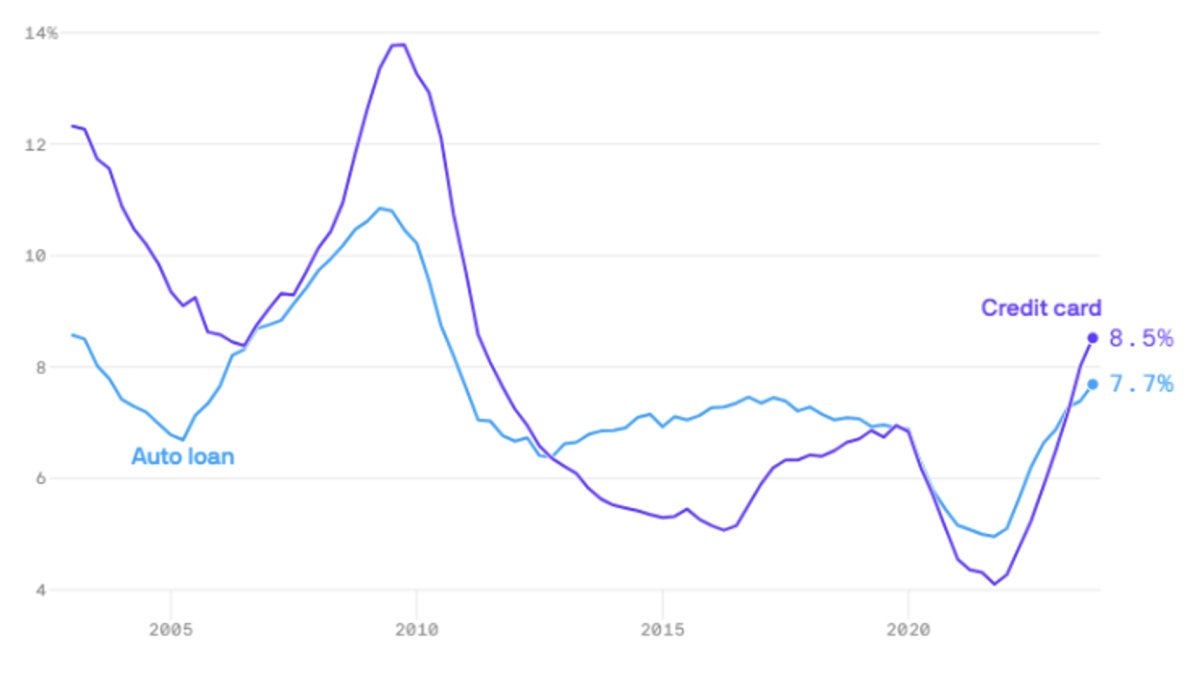

Consumer Credit Card & Loan Debt:

Source: FE Analytics

Whilst the difference in performance is at least partially due to the Magnificent 7/5/3 (delete as appropriate) euphoria, small capitalisation stocks lagging is also a signal that the domestic facing stocks, those more exposed to the US consumer, are faring worse than their more global peers.

Consumer behaviour and economic health

This is a message that is being repeated by many consumer-facing businesses in the US that are exposed to low-income groups, such as McDonalds and Starbucks. “Where you see the pressure with the US consumer is that low-income consumer, so call it $45,000 and under. That consumer is pressured," McDonalds CEO Christopher Kempczinski told investors last month. "If you think about middle income, high income, we're not seeing any real change in behaviour with those. But the battleground is certainly with that low-income consumer."

Why is this important?

The messages emanating from business owners and small cap stocks may well be telling us that the US economy is not as strong as the S&P 500 would make you believe. Credit card delinquency rates have also risen to levels not seen for decades, a further sign that there are cracks appearing.

Source: New York Federal Reserve

Latest News Next Article Previous Article