Why Cash Flow Modelling may be the Key to Achieving Your Dreams

Wednesday 3 July, 2024

While we naturally look to the future when it comes to money, it's equally important to optimise our current financial decisions to make the best use of our resources.

Visualising your financial future

Cash flow modelling serves as a powerful tool to help clients visualise their financial future and proactively work towards their monetary goals. It allows clients to envisage upcoming expenses, major aspirations, and dream purchases, all while aligning with their current financial plans, thereby transforming aspirations into achievable realities.

Understanding financial security and goals

Through dynamic ‘on the fly’ planning, facilitated by financial advisers, clients can explore different definitions of financial security, from owning a modest, mortgage-free home to acquiring a holiday retreat abroad for family gatherings. Such discussions are pivotal in understanding lifestyle aspirations and tailoring financial strategies across various life phases.

Technology has made cash flow planning even more appealing

Advancements in technology have revolutionised cash flow planning, making it more interactive and engaging. Lonsdale cash flow modelling tools enable our financial advisers to quickly illustrate the impact of financial decisions, such as the effect of a salary increase on pension funds or the benefits of modest monthly savings adjustments.

Navigating complexity and simplifying decisions

"While technology enhances the ease of cash flow modelling, it's crucial to avoid unnecessary complexity. Financial advisers play a critical role in distinguishing the capabilities of cash flow modelling, ensuring it complements but doesn't overshadow other financial tools in providing comprehensive advice."

Conor McClean, Independent Financial Adviser, St Albans.

Building and maintaining your cash flow model

There are many things to consider when undertaking cash flow modelling. With the constant improvement of technology, cash flow modelling can easily veer into the world of over-complication.

It is important to differentiate what cash flow modelling can and cannot illustrate. Where it can be used to give advice and where other tools may be more beneficial to use when it comes to financial advice. Building your cash flow model alongside your financial adviser is therefore recommended.

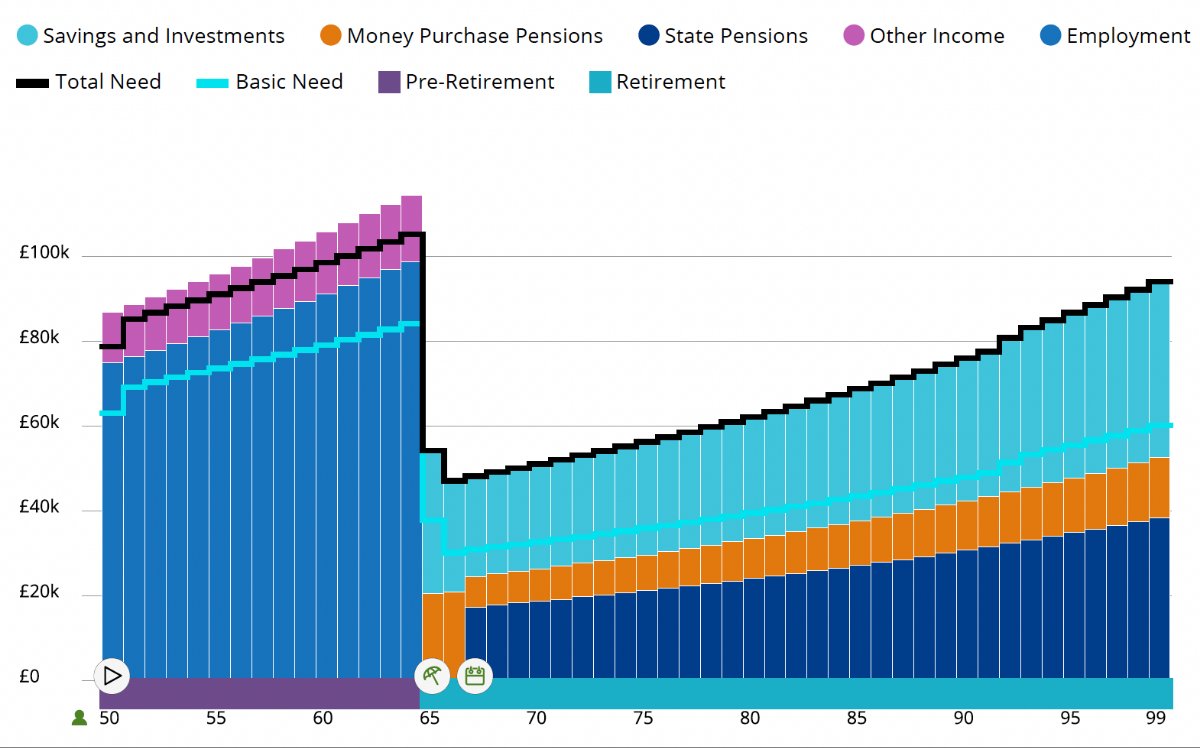

The following chart illustrates a Cash Flow Model as prepared by a Lonsdale Financial Adviser:

Goal-setting and financial planning

Cash flow modelling is built on data and the understanding of what the goals might look like as well as demonstrating the path your finances may take. It is important to collect information on current levels of income and expenditures. For example, your day-to-day life costs and the details of less frequent spending. Any predicted changes to these income and expenditures need to be captured and modelled.

Monitoring and adjusting your financial plan

Regular reviews of your cash flow model, ideally annually or after significant life events, are essential. These reviews help ensure financial goals remain achievable and allow for adjustments to accommodate changing circumstances or aspirations.

Partnering with your adviser for financial stability

After establishing your initial cash flow model, your financial adviser will take you through a goal-setting journey that includes both essential expenses and your dream expenditures. This will also involve exploring what retirement might look like for you and the level of expenditure you anticipate.

Next, your financial adviser will examine the output to determine if your goals have been met, identify alternative ways to achieve unmet goals, and decide if any goals or life phases should be adjusted.

An initial review of your cash flow model will assess whether surplus money can be put to better use, identify potential debts and shortfalls, and determine strategies to address them. The model will ensure that the most tax-efficient wrappers are utilised while maintaining your required level of flexibility.

You and your financial advisor will then evaluate the impact of changing your retirement spending expectations and retirement age to see how these adjustments influence your overall life plan.

Revisiting your cash flow model regularly

It is crucial to revisit your cash flow model at least annually to ensure its validity. Additionally, it is important to update your cash flow plans after major life events or before making significant purchases to keep your goals on track.

Lonsdale advisers play a key role in guiding you through your cash flow planning process, making necessary tweaks to improve your financial position. We will assist in building your financial resilience and demonstrate that, although investing involves risks, a sound financial plan can help weather the volatility of the market.

In times of economic uncertainty, revisiting your cash flow plan with your advisor is especially important for reassurance about your financial situation. Your plan will reflect your true level of spending, particularly in periods of high inflation.

Conor McClean, Independent Financial Adviser, St Albans said:

“In short, cash flow planning with your Lonsdale financial adviser is extremely beneficial for ensuring financial stability, aiding decision-making, budgeting, and making the best use of your money to achieve your aspirations and goals.”

Please contact your local Lonsdale financial adviser about creating a new financial plan or revisiting your existing one. Please complete our booking consultation form and your local financial adviser in Chippenham, St Albans, Harpenden, Stafford, Barnet, Ringwood, Leeds/Bradford or Ware will contact you.

Please note: The value of your investment can fall as well as rise and is not guaranteed. The Financial Conduct Authority does not regulate Cashflow Modelling, Tax and Estate Planning. The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested.

Latest News Next Article Previous Article